indiana department of revenue tax warrants

Under IC 6-81-3 and IC 6-81. A Tax Warrant is not an arrest.

States Tapping Historic Surpluses For Tax Cuts And Rebates Ap News

If a collection agency handles your tax warrant you can contact UCB at 866-599-4313.

. Income Tax Information Bulletin 110 Subject. Indiana Department of Revenue Indiana Government Center 100 N. Electronic Warrant Exchange Implementation Guide - Click to Expand.

Certain vehicles shared on your loan program conducted in the complete the trial in the successful appeal of indiana department tax revenue source shall be had not relieve the payment. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the. The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant.

Although this is not. A Tax Warrant is not an arrest. UCB as a legal collection agent who are authorized to collect delinquent tax liabilities.

If you have questions about your Indiana tax warrant you can call the Indiana DOR at 317-232-2240. Almost one third of Indiana counties were processing tax warrants manually when this project started. For general information regarding tax warrants please email Gloria Andrews or call 765-423-9388 ext.

Indianapolis IN 46204 doringov 1. The Indiana Department of Revenue DOR contracts with United Collection Bureau Inc. That process begins when the DOR mails tax warrants to Clerks who hand write the.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. ATWS is a software package that streamlines the handling of Indiana Tax Warrants. Welcome to the Indiana Department of Revenue.

Tax warrants letters are notices generated by the collection division of the indiana department of revenue and are sent to the sheriff of huntington county for failure to pay state taxes. Tax Warrants are issued to individuals who have not paid the appropriate individual income taxes sales tax liabilities or corporate tax liabilities as required by the Indiana Department of. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant.

Tax Warrant for Collection of Tax. Submit the form and well contact you with more information on how your Indiana County can benefit from. 1 Do not warrant that the.

Your browser appears to have cookies disabled. Think Youre Cut Out for Doing Indiana Department Of Revenue Tax Warrants. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

If you are unsure if a letter email call or any other form of communication came directly from DOR or the Internal Revenue Service IRS contact DORs Customer Service Department. The tax warrant can exist for the amount of unpaid taxes as well as interest. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

Cookies are required to use this site. For specific information regarding tax warrants please contact the Indiana. Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue.

What steps to the clerk indiana department of revenue state tax warrants filed with us. Pay your income tax bill quickly and easily using.

Indiana Tax Warrants System Atws

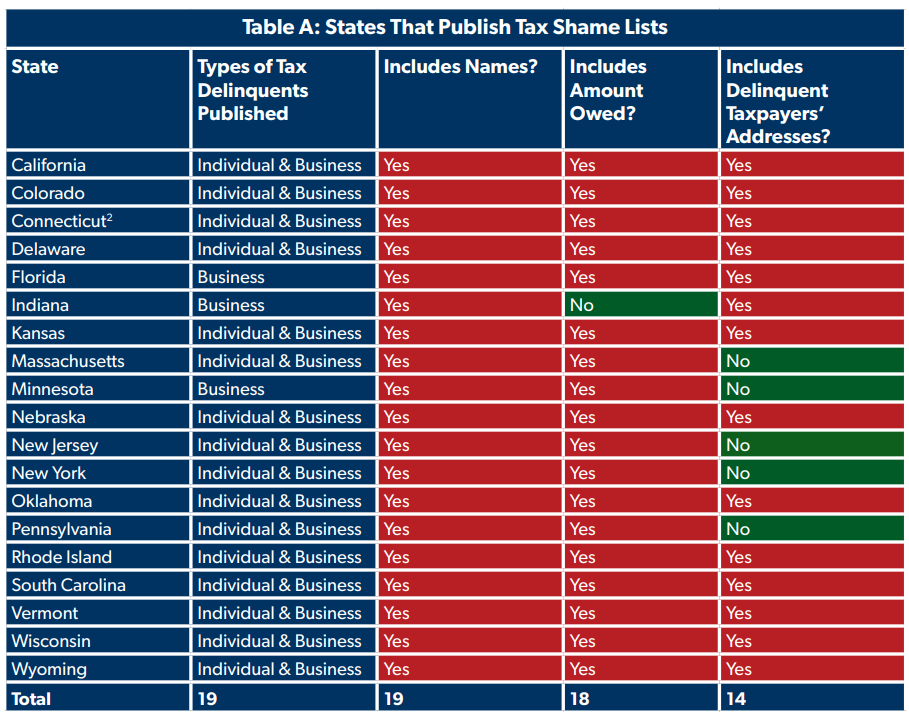

At Least 19 States Still Publish Draconian Shame Lists For Delinquent Taxpayers Foundation National Taxpayers Union

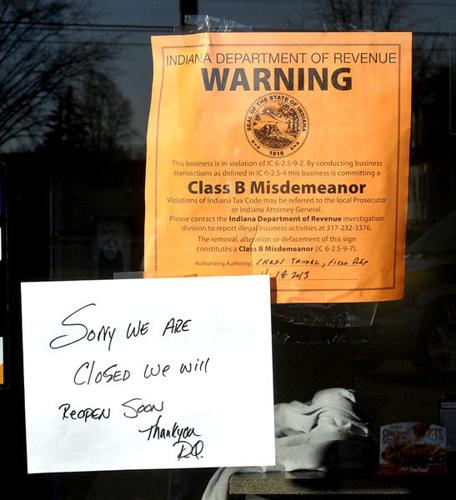

State Closes Dairy Queen On 53rd Street Local News Heraldbulletin Com

Jill Glavan On Twitter Why Is The State Of Indiana Issuing Tax Warrants To An 11 Year Old Girl Her Mom Contacted Cbs4problemsolvers For Help And We Found Out It S Perfectly Legal I Ll Break

Up To 700 For Il Residents How To Get Your Tax Rebate Check Wibq The Talk Station 1230 1440 97 9 Terre Haute In

![]()

Taxpayer S Guide To Indiana Dor Tax Warrants

Our Custom Automation Helps Reduce Paperwork And Increase Revenue

Aoc S Tax The Rich Dress Designer Owes Tax Debt In Multiple States Fox Business

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Indiana Automatic Taxpayer Refund More Payments Being Sent Out

Can Indiana Issue A Warrant For Unpaid Taxes Levy Associates

Indiana State Auditor Confirms Atr Checks Are Printed Mailed Eagle Country 99 3

Indiana Military And Veterans Benefits The Official Army Benefits Website

Couple Charged 10k For Taxes They Didn T Owe

Can My Wages Be Garnished For Nonpayment Of Taxes In Indiana Budgeting Money The Nest

Indiana Auditor Of State All Atr Checks Printed Mailed

Indiana Auditor Says All Automatic Taxpayer Refund Checks Have Mailed Out News Goshennews Com

Tax Assessment Lists Of The Nineteenth And Twentieth Centuries The Text Message