michigan gas tax increase

The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic. The increase is capped at 5 even if actual inflation is higher.

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

At the same time gas prices are on the rise an increase in Michigan gas taxes went into effect on Sunday.

. When gas is 389 per gallon that amounts to another 21 cents per gallon in taxes. The state fuel tax is levied in addition to the federal gas tax. For fuel purchased January 1 2017 and after.

When those three taxes are added. Truckers pay an additional 113. Currently Michigans fuel excise tax is 263 cents per gallon cpg.

LPG 15 per gallon. The state gas tax is increasing by seven-cents per gallon on Sunday. It will have a 53 increase due.

LANSING It took a tie-breaking vote by Lt. Compared to other states Table 1 shows Michigans gasoline tax ranked 27th in 2019 and was lower. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct.

Gasoline 19 per gallon. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. For fuel purchased December 31 2016 and before.

Whether gas costs 2 per gallon or 4 per gallon the amount collected for those two taxes remains the same. Vehicle registration fees will also jump by 20-percent for cars and trucks. The 2015 legislation that increased Michigans tax rate to 263 cents per gallon in 2017 also included provisions to begin annual inflationary adjustments lesser of inflation or 5 in the tax rate beginning January 1 2022.

Gretchen Whitmers proposal to raise Michigan gas taxes by 45 cents per gallon is likely dead said House Democratic Leader Christine Greig Thursday. The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax. Whitmer also has proposed a 45-cent-per-gallon increase in Michigans fuel tax.

The Michigan Legislature upped the states gasoline tax in 2017 from 19 cpg to 263 cpg after then-Gov. 1 2020 an action she said would raise more than 2 billion annually to fix. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well.

The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in October 2020. Diesel Fuel 15 per gallon. Compressed Natural Gas CNG 0184 per gallon.

Under the governors proposal a 45-cent increase would occur in three 15-cent increments over a one-year period. Trouble is the sales tax charged for gasoline doesnt go to roads. Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents.

Michigan House Dem leader says Whitmers 45-cent gas tax is probably dead. The current state gas tax is 263 cents per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Throw in the 184. The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in October 2020. 52 rows The state with the lowest tax rate on gasoline is Alaska at 00895 gallon followed.

These tax rates are based on. As of January of this year the average price of a gallon of gasoline in Michigan was 237. But you also pay the Michigan 6 per - cent sales tax.

And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. --Voters in Michigan are deciding on a constitutional amendment this week that could trigger an approximately 10-cent-per-gallon CPG increase in the gasoline tax to raise money for infrastructureProposal 1 which was put on the ballot after agreement late last year by the state legislature and Governor Rick Snyder R has two parts said The Detroit. In 2019 Democratic Gov.

Brian Calley but the Senate passed a 15-cent hike in the states gas tax to help raise 14 billion to 15 billion a year to fix Michigans roads. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon. Gretchen Whitmer proposed increasing the gas tax by 45 cents in order to repair Michigan s roads.

When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. Michigan Reports 3120 New COVID-19. Per gallon state gas tax and the 184 cents per gallon federal fuel tax.

Michigan rang in the new year with hikes at the gas pumps as drivers are paying 73 cents more per gallon in gasoline taxes because of a package of transportation-related tax hikes signed into law in 2015 by Gov. Republicans have said the proposal is a non-starter so I think we have to have these other options the Farmington Hills. LANSING Gov.

Opponents of the Governors proposal to increase the gas tax point out that it would at current prices be a 171 increase and make Michigan the state with the highest gasoline tax in the country. They say that the proposal like others before it is not just for roads but would shift current funding already earmarked for roads from the. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund.

But both Republicans and lawmakers from her own party balked at the proposal which would have almost tripled Michigan s gas tax giving the state the highest gas taxes in the nation.

1924 Ad Antique Enclosed Hudson Coach Automobile Super Six Chassis Car Hudson Car Car Advertising Automobile Advertising

Fossil Fuel Subsidies The Real Job Killers Go To Www 350 Org Subsidies To Support The End Polluter Welfare Act Save Planet Earth Oil And Gas 350 Org

.png)

Map State Gasoline Tax Rates Tax Foundation

Hearthside To Invest Nearly 10 7 Million In Kentwood Mi Food Processor Recipes Food Processed Food

Steven Johnson District 72 Steven Johnson Johnson Steve

Forex Trading Learnhowtoforex Learn Forex Trading Forex Trading Forex Trading Quotes

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

U S States With Highest Gas Tax 2021 Statista

Induced Demand As A Cause Of Traffic Congestion And Urban Sprawl The Use Of Gasoline Tax Money To Build Highways Geography Class Traffic Congestion Congestion

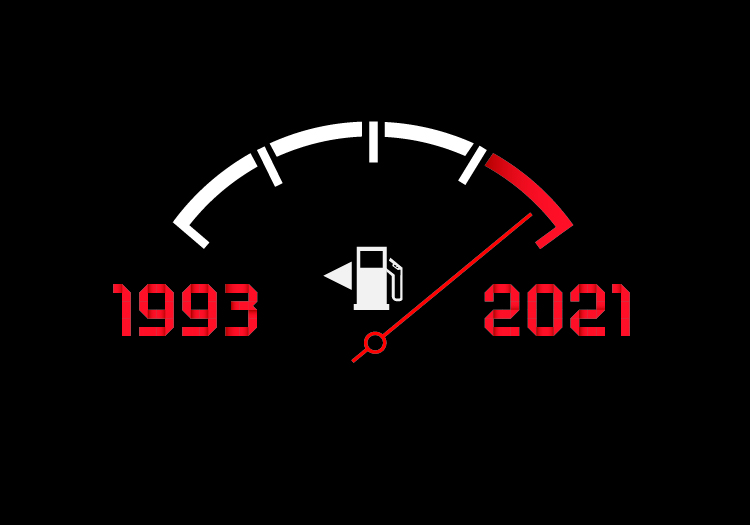

How Long Has It Been Since Your State Raised Its Gas Tax Itep

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

Home For Sale 4832 Sheffer Road Prescott Mi 48756 Prescott Outdoor Structures Property Records

Pothole Season Is Upon Michigan Drivers Here S How You Can Report A Problem In 2022 Gas Tax Infrastructure Open Source Programs

Aerial Photo Of Iron Ore Tailings Pond Marquette County Michigan Up Mi United States Aerial View Aerial Photo Aerial Photograph

Oil Soaked Interest Groups Are Doing Their Best To Kill Mass Transit Billmoyers Com Interest Groups Interesting Things Gas Tax

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

India Electric Rickshaw Battery Market Research Report 2024 Marketing Research Companies Business Intelligence